|

7

THEORETICAL FOUNDATION

2.1 The meaning of shopping mall

To the residents of metropolitan city, the word ‘shopping mall’ sounds very familiar,

since this word can be heard in daily conversation. As living human beings who need to

fulfill daily basic needs such as food and clothes, people purchase those things in a place

called a market.

(Kotler

and

Armstrong,

2004)

defined

a

market as the

set of all actual and potential

buyers of a product or service. These buyers share a particular need or necessity that can

be satisfied through exchange relationships. The size of a market depends on the number

of people who exhibit the need, have resources to engage in exchange, and are willing to

exchange these resources for what they want. The term market stood for the place where

buyers and sellers gathered to exchange their goods. Economists use the term market to

refer

to

a

collection

of

buyers

and

sellers

who

transact

in

a

particular

product

class

(Kotler and Armstrong, 2004).

(Wee, 2005) described the term ‘malls’ as a huge enclosure housing different formats of

retailers, forming ideal shopping destination in Metros, large cities and easily accessible.

The value proposition of malls is variety of shops available close to each other, and all

are under a common roof and uniform shopping environment which is an ideal place for

hangouts.

|

|

8

(Kotler and Armstrong, 2004) defined shopping center as a group of retail businesses

planned,

developed,

owned,

and

managed

as

a unit. A regional shopping

center,

or

regional shopping mall, the largest and most dramatic shopping center, contains from 40

to over 200 stores. Retail is defined as all activities involved in selling goods or services

directly

to

final consumers

for their personal or

non-business

use. Retailer

is business

whose sales come primarily from retailing (Kotler and Armstrong, 2004).

Location is important to shopping mall because it means the shopping mall is where its

target shoppers would like to be. Accessibility of a shopping mall can be measured by

looking at

the ease/difficulty to reach by public

transportation.

Location of a shopping

mall dictates demographics of the area, growth patterns, traffic patterns and competitor’s

location (Marrioti, 2004).

According to (Ahmed, Gingold, Dahari. 2005), shopping malls represent a unique form

of shopping environment, and have become social places where people engage not only

in buying and selling activities but also in social activities, such as going to the cinema,

having

meal,

getting

together

with

friends or

family,

etc.

As

a

result, both

shopping

malls and individual stores must create environment that simultaneously allow people to

shop and be entertained.

With the growth of the malls industry, where various new malls were built and millions

of square feet of retail spaces were added to existing shopping malls each year (Berman

and Evans, 2004), many researches were conducted to deal with different aspects of

shopping malls. The relationship between the malls manager and tenant was one of the

|

|

9

addressed aspects

(Kirkup and

Rafiq,

1994;

Prendargast

et

al., 1996,

1998;

Bruwer,

1997; Addae – Dapaah and Yeo, 1999).

According to Ruiz (1999), some shoppers were attracted to malls purely due to

economic motives; others were attracted due to emotional motives, while multi-purpose

shoppers

had

a

combination

of

these

motives.

For

example

in

Chilly, customers

visit

malls mostly because of purchasing factors, while American customers are more likely

to be leisure-driven, which is around entertainment (Nicholls et al,. 2000). Nicholls et al.

(2000) found that today’s mall patrons tend to be more leisure-driven than shoppers in

the

early

1990s.

Martin

and

Turley

(2004)

analyzed

the

attitudes

of young

segment

(between 19 and 25 years old) towards shopping malls and consumption factors. The

researchers found that young people were more leisure-motivated rather than

purchasing-motivated. Tordkildsen (1992) defined leisure as simply contrast with work,

where leisure is seen as synonymous to recreation or can be also defined as virtually any

satisfying experience. There is an evidence of an increasing proportion of people saying

that they spend time looking around the shops as a leisure activity (Mintel, 2000).

According to LeHew and Fairhurst (2000), shopping center attributes are generally

divided

into

two

groups:

Fixed/long-term and Variable/short

term.

Fixed/long-term

means attributes that can be kept constantly or over a long period of time, which include

location, size, number of car park space, facilities (toilet, escalators, elevators), quality

(design,

shape,

layout,

age),

shopping

atmosphere (lighting, spacious and air-

conditioning),

and

availability

of

other

amenities

(cinema,

food

court, restaurants). In

contrast, short-term attributes are

factors that can be changed

within a short period of

|

|

10

time (one year or less), such as an ideal hangout place with family and friends, flexible

opening

hours,

one-stop shopping,

competition, cleanliness, security,

activities,

events

and promotions and services (Ibrahim et al., 2003).

2.1.2 Shopping mall development in Indonesia

Basically, shopping mall development is similar across Asian countries including in

Jakarta, the capital city of Indonesia, where places for one-stop shopping can be found

especially in Central Business District. Indonesia’s retail growth has become one of the

highest growth rates in Asia. In the first semester of 2007 it reached 17.5%, compared to

11.8 in China, 12% in Philippines, 8.6% in Singapore and 7% in Malaysia. Since 2005

Jakarta has been promoted as a shopping destination to attract overseas shoppers.

Indonesia offers big opportunities for retailers. In other

words, the culture of one-stop

shopping has bombarded the Asian countries.

2.1.3 Indonesian consumers profile

Indonesia is such a huge market for both

domestic and imported goods and services.

Indonesian market is the biggest potential market among ASEAN countries:

•

Indonesian population based on province (according to a survey conducted by a

research company, MARS Indonesia, in January 2009)

|

11

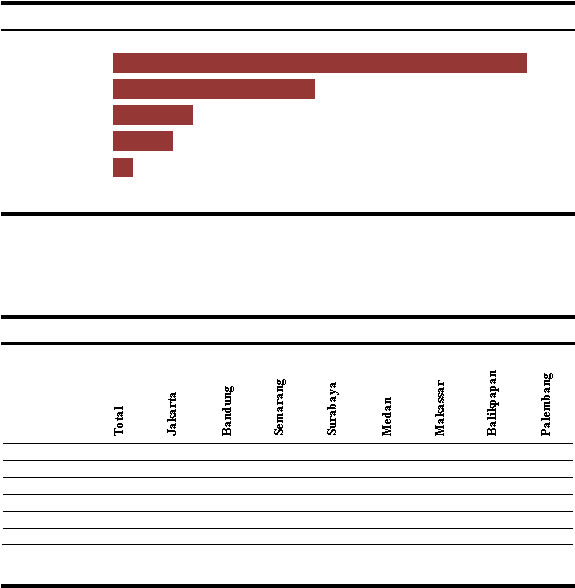

Graph 2.1.1: Population of Indonesian consumers based on province

Nanggroe Aceh Darussalam

North Sumatera

West Sumatera

Riau

Jambi

South Sumatera

Bengkulu

Lampung

Bangka Belitung

Island

Jakarta

West Java

Central Java

Yogyakarta

East Java

4,098

4,507

7,181

2,860

7,197

1,750

7,732

1,030

8,929

3,408

(X1000)

13,067

32,341

36,128

41,843

Banten

10,378

Bali

3,553

West Nusa Tenggara

4,632

East Nusa Tenggara

4,360

West Kalimantan

4,695

Central Kalimantan

2,377

South Kalimantan

3,450

East Kalimantan

3,113

North Celebes

2,251

Central Celebes

2,592

South Celebes

Southeast Celebes

2,307

8,884

Gorontalo

900

Maluku

1,351

North Maluku

958

Source: Central Bureau of Statistics

Graph 2.1.1. Shows that West Java

has

the biggest

number of population with

41,834,000 residents.

|

12

Graph 2.1.2: Population of Indonesian Consumers based on City

Band a Aceh

Med

an

Padang

Pekanbaru

Jamb i

200.716

775.209

766.852

487.053

2.055.392

Palemb

ang

Bengkulu

269.091

1.375.765

Band ar Lamp

ung

Pang

kal Pinang

Jakarta

Bodetabek

Band ung

143.963

823.602

1.991.820

3.892.687

8.929.200

Semarang

Yo g yakarta

Surab aya

531.044

1.412.082

2.631.115

Serang

Denp asar

Mataram

Kupang

Po ntianak

Palang

karaya

Banjarmasin

Balikp ap

an

Manad o

Palu

487.419

354.177

274.101

487.039

197.497

608.930

544.602

420.769

315.137

1.951.331

Makassar

Kend ari

Go ro

ntalo

Ambon

Ternate

240.868

148.545

258.619

149.685

1.216.936

Graph 2.1.2. Shows that Jakarta is the most populated city in Indonesia.

Graph 2.1.3: Indonesian Consumers based on Education Level (%)

Post Graduate Degrees (S2/S3)

Undertaking Post Graduate Studies (S2/S3)

University Graduates (S1)

Undertaking Undergraduate Studies (S1)

Diploma/Non-Degree

Undertaking

Diploma

Programs

Senior

High

School

Graduates

Junior High School Graduates

Elementary School Graduates

0.01

0.1

1.9

1.4

2.7

0.8

13.1

15.8

26.7

Source: MARS Indonesia

Graph

2.1.3.

Shows

that

most

of

Indonesian

citizens (26.7%) are

senior

high

school graduates.

|

13

Banda Aceh

53.859

Medan

407.428

Padang

170.208

Pekanbaru

167.359

Jambi

107.370

Palembang

303.588

Bengkulu

66.241

Bandar Lampung

174.037

Pangkal Pinang

Jakarta

37.003

Serang

Denpasar

108.755

450.875

Mataram

84.637

Kupang

56.546

Pontianak

124.097

Palangkaraya

48.662

Banjarmasin

151.401

Balikpapan

137.705

Manado

103.561

Palu

65.285

Makassar

257.987

Kendari

57.006

Gorontalo

38.596

Ambon

55.112

Ternate

29.633

Graph 2.1.4: Distribution of Indonesian Consumers based on Age and Sex

Age

960.538

1.098.485

1.142.037

1.114.657

1.027.470

763.707

324.609

277.276

352.307

453.358

551.637

633.717

65+

60 - 64

55 - 59

50 - 54

45 - 49

40 - 44

35 - 39

30 - 34

25 - 29

20 - 24

15 - 19

10 - 14

335.478

259.760

327.738

418.797

520.062

649.277

815.633

931.611

1.110.456

1.250.838

1.155.483

973.079

958.358

5 - 9

908.261

1.077.138

Male

0 - 4

Female

1.025.479

Source: Central Bureau of Statistics

Graph 2.1.4. Shows that most of Indonesian citizens are in their productive age, 20-24

years old.

Graph 2.1.5: Population of Households in Main Cities of Indonesia

Bandung

Semarang

Yogyakarta

Surabaya

467.893

329.544

105.716

625.534

3.199.886

Source: Central Bureau of Statistics processed by MARS

Graphic 2.1.5. Shows that Jakarta is occupied by the largest number of household

population.

|

14

Table 2.1.6: Distribution of Indonesian Consumers based on Social-Economic Class

(%)

Social Economic Status

Amount of Expenditure (IDR)

%

E

< IDR 600,000

10.3

D

IDR 600,000 – 900,000

16.7

C

IDR 900,001 – 1,750,000

47.7

B

IDR 1,750,001 – 2,500,000

11.0

A

> IDR 2,500,000

14.3

Source: MARS Indonesia

Table 2.1.6. Shows that

most of

Indonesian citizens are

in status C, which

means that

their expenditure amounts between IDR 900,001 to IDR 1,750,000 per month.

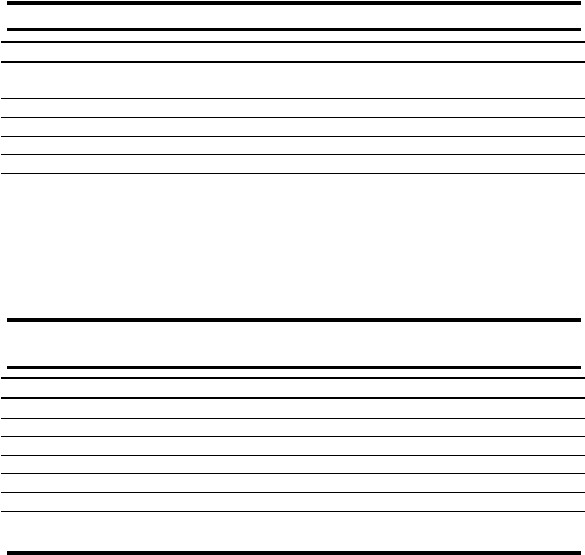

Graph 2.1.7: Visit to Shopping Malls in the last month (%)

Total

43,0

Jakarta

Bandung

Semarang

Surabaya

Medan

Makassar

33,3

34,1

37,1

40,1

43,8

50,6

Balikpapan

Palembang

34,1

38,1

18 - 25 tahun

26 - 34 tahun

35 - 55 tahun

29,8

47,9

53,6

A

B

C

D

&

E

Source: MARS Indonesia

23,3

40,0

53,6

67,2

Graph 2.1.7. Shows that 50.6% of Jakarta citizens visited shopping

malls in last one

month. 53.6% are in age group 18-25 years old and 67.2% are in A social class. These

groups of people are the target market of shopping malls

|

15

Graph 2.1.8: Frequency of Visit to Shopping Malls in the last month (%)

1x/month

2x/month

3x/month

4x/month

> 4x/month

2.6

10.4

7.7

25.9

53.4

Source: MARS Indonesia

Graph 2.1.8. Shows that 53.4% of Indonesian citizens go to shopping center only once a

month.

Table 2.1.9: Frequency of Visit in the last month based on City (%)

Frequency

1x/month

53.4

58.1

29.7

58.1

39.0

70.3

58.3

47.3

59.6

2x/month

25.9

22.9

36.2

23.8

30.9

24.0

21.4

34.6

26.4

3x/month

10.4

10.9

14.7

8.4

12.0

4.9

8.8

12.1

3.3

4x/month

7.7

5.9

18.1

6.5

10.1

0.5

10.0

3.5

8.8

>

4x/month

2.6

2.3

1.2

3.2

7.9

0.3

1.5

2.5

1.9

Source: MARS Indonesia

Table 2.1.9. Shows 58.1% of Jakarta

residents

visit shopping

mall once a

month and

22.9% of them visit shopping mall twice a month.

|

16

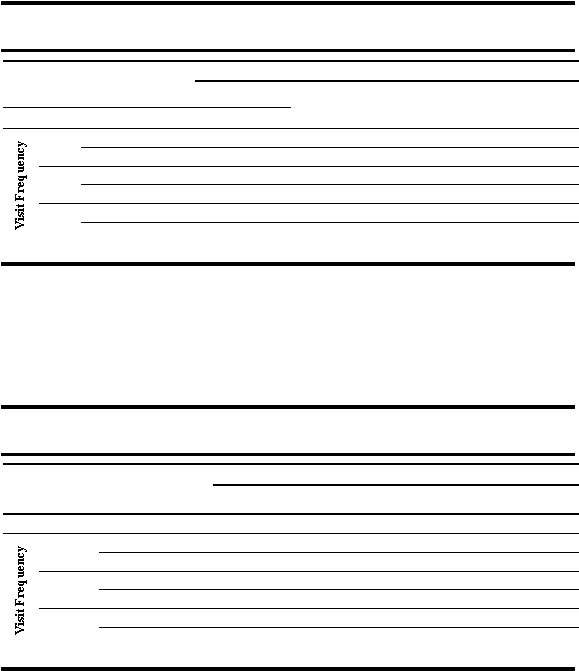

Table 2.1.10: Frequency of Visit in the last month based on Age (%)

Total

Age groups

Frequency

18 - 25 years

26 - 34 years

35 -

55 years

2x/month

25.9

28.3

26.6

21.5

3x/month

10.4

13.4

9.8

7.0

4x/month

7.7

8.9

7.5

6.6

>

4x/month

2.6

4.4

1.7

1.4

Table 2.1.10. Shows that the younger their age ranges the more frequently people go to

shopping malls and the older their age range the more rarely they go to shopping malls.

It shows that young Indonesian people like to socialize in the mall

Table 2.1.11 : Frequency of Visit in the last month based on Social-Economic Status

(%)

Total

SES

Frequency

A B

C

D & E

1x/month

53.4

49.9

50.4

54.2

62.7

2x/month

25.9

24.7

29.4

26.8

21.9

3x/month

10.4

15.0

7.5

9.5

6.0

4x/month

7.7

7.0

7.9

8.4

7.2

>

4x/month

2.6

3.5

4.8

1.1

2.3

Source: MARS Indonesia

Table 2.1.11 shows

that

most residents across different social-economic status mostly

visited shopping malls only once a month.

|

17

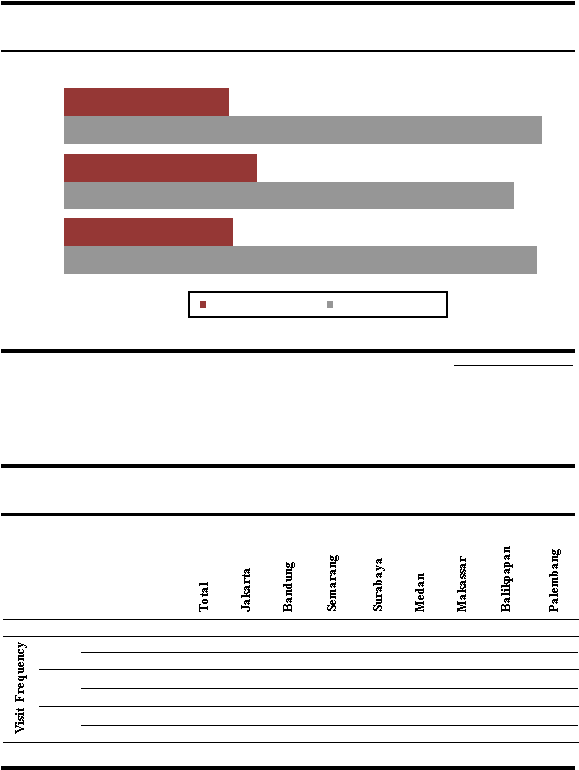

Graph 2.1.12: Comparison of Visit Frequency between weekends and working

days (%)

once

twice

>

twice

25.7

30.0

26.4

74.3

70.0

73.6

Working days

Weekends

Source: MARS Indonesia

Graphic

2.1.12

shows

that

most of

Indonesian citizens

do

their

shopping

during

the

weekends

Table 2.1.13: Comparison of Visit Frequency between Working days and

Weekends based on City (%)

Comparison of Visit

Frequency between Working

Days and Weekends

1x

Working Days

25.7

22.8

40.3

26.3

29.2

26.2

27.0

30.4

13.9

Weekends

74.3

77.2

59.7

73.7

70.8

73.8

73.0

69.6

86.1

2x

Working Days

30.0

44.3

20.5

9.8

24.2

20.2

4.5

8.6

20.9

Weekends

70.0

55.7

79.5

90.2

75.8

79.8

95.5

91.4

79.1

> 2x

Working Days

26.4

25.2

13.6

53.3

36.8

35.8

23.5

55.8

16.9

Weekends

73.6

74.8

86.4

46.7

63.2

64.2

76.5

44.2

83.1

Source: MARS Indonesia

Table 2.1.13 Shows that around 75% of Indonesian citizens visit shopping malls during

the weekends.

|

18

Table 2.1.14:

Comparison of Visit Frequency between Working Days and

Weekends based on Age (%)

Comparison of Visit

Frequency between Working

Total

Age Groups

Days and Weekends

18 – 25 years

26 - 34 years

35 -

55 years

1x

2x

> 2x

Working Days

25.7

25.9

27.3

23.1

Weekends

74.3

74.1

72.7

76.9

Working Days

30.0

38.4

19.9

28.9

Weekends

70.0

61.6

80.1

71.1

Working Days

26.4

31.2

29.9

7.5

Weekends

73.6

68.8

70.1

92.5

Source: MARS Indonesia

Table 2.1.14. Shows that based on the age groups

most of of Indonesian citizens

visit

shopping malls during the weekends.

Table 2.1.15:

Comparison of Visit Frequency between Working Days and

Weekends based on Social-Economic Status (%)

Comparison of Visit Frequency

between Working Days and

Weekends

Total

SES

A

B

C

D/E

1x

2x

> 2x

Working Days

25.7

21.8

27.4

29.1

22.6

Weekends

74.3

78.2

72.6

70.9

77.4

Working Days

30.0

43.9

23.7

20.9

23.6

Weekends

70.0

56.1

76.3

79.1

76.4

Working Days

26.4

37.9

40.3

14.3

22.4

Weekends

73.6

62.1

59.7

85.7

77.6

Source: MARS Indonesia

Table 2.1.15. Shows most of Indonesian citizens go to shopping centre during

holiday

|

|

19

2.1.4 Indonesian consumer behavior in general

After being engaged in conducting researches for many years, Handi Irawan, Chairman

of Frontier Consulting Group, has found that Indonesian Customers generally posses the

following characters:

•

Indonesian

customers

are

short-term

minded.

Indonesian customers like to

consume or

use product

fast and everything

instant. That is why ExtraJoss, Hemaviton

Jreng, Indomie are very marketable in Indonesia. However, it is still hard to market

insurance

to

Indonesian

customers

because

most

of

them are

reluctant

to

invest

on

something whose benefit could only be obtained in a decade later. The strategy used to

determine whether Indonesian customers are still short-term minded or not is by offering

them to choose between a discount and a direct gift. Surveys conducted by AC Nielsen

show that 76 % of the customers prefer a discount and only 18 % prefer a direct gift.

• Indonesian customers are dominated

by

unplanned behavior.

This

fact benefits

the

shopping

malls

because

the

longer

the Indonesian

customers

stay

in

a

certain

shopping mall, the more money they would spend. In addition, their buying behavior

often becomes impulsive buying behavior as it is unplanned, an instant decision to buy a

certain product without considering the functional value, but merely for self satisfaction,

excitement, and hedonism while disregarding the post-purchase use of the product

(Rook, 1987).

Indonesian

customers

experience

impulse buying

behavior

during

the discount

season

in

retail

stores,

and

this

may

lead to

unplanned

behavior.

During

the

discount

season,

customers

only

focus on

discounted prices, and become

less

attentive

to any

|

|

20

other

factors which are supposed to be considered in purchasing decision, such as

the

cases that are also experienced by UAE customers.

• Indonesian

customers

love

to

socialize.

The

culture or

the

habit

of

Indonesian

people is to love socializing and gathering

with

informal community

members.

This

is

the

habit of

not only rural residents but also

urban citizens. They tend to

have

very

strong social life. Commonly they share information about anything, including family

life, clothing style, food, cosmetics, health maintenance, etc. During the gathering Word

of Mouth (WOM) communication works effectively.

Vera Tjugiaro batch 2007 conducted a research with 171 respondents, 80.1% of

whom

are

between

20

and

24

years

old.

She

found

that

76.6%

of

their

individual

decision making was influenced by friends. It shows how WOM communication works

among friends.

•

Indonesian customers perceive foreign brand names as high quality. In the mind

of

Indonesian

customers,

foreign

products have relatively higher quality than local

products. They expect that by consuming or

wearing foreign brands they can gain

confidence and prestige. In other words, they do not seem to trust domestic products.

There

are even

some

local

brands which

are still

using

foreign

brand names

(similar

sounds), such as Stanley Adams, Polytron, Detron and Bellagio Deodorant Spray for

Homme. Giving foreign names to those products are the firms’ tactics to make

consumers perceive them as foreign products at a glance.

|

|

21

2.2 Shopping malls across Jakarta

Shopping malls in west Jakarta:

Mall Ciputra

It

was

named

Citraland

Mall,

opened

on

February

26

th

,1993. Owned

by

PT.

Ciputra Property, Tbk., this mall is completed by the existence of Hotel Ciputra

at

the

top building.

It

is strategically

located on

transportation

intersection

in

West Jakarta, and nearby two famous universities, Tarumanegara and Trisakti

Universities. Main tenants of this mall are Matahari Department Store, Gramedia

Bookstore, Gunung Agung Bookstore, 21 cineplex, Hero Supermarket, Gold’s

Gym, McDonald, Starbucks, Pizza Hut and KFC.

Mall Puri Indah

This

mall

is

located

in

Puri

Indah, with

Carrefour

nearby,

and

has

three

department stores, which are Batik Keris, Index and Ace Hardware.

Mall Taman Anggrek

One of top

shopping

malls

in Jakarta, opened

in 1996 as the largest shopping

mall in South East Asia, was designed by American architects, Altoon & Porter.

This mall is owned and managed by Mulia Group, and has

eight residential

towers, with more than 500 specialized stores and two department stores, Metro

and Matahari; Fitness first as its fitness center. Well known flagship stores such

as Zara, Mango, Guess and Aigner

can be found here. This mall is also very

popular for its indoor ice skating rink.

|

|

22

Shopping malls in Central Jakarta:

Plaza Indonesia

Plaza Indonesia is located near the famous landmark, the Selamat Datang

(welcome)

statue.

It

is

owned

by PT.

Global

Mediacom,

Tbk.

(RCTI)

and

Sinarmas Group. It is the first high end shopping mall in Jakarta opened in 1990,

and

amazingly

until

today

it

remains

to be

one of top

shopping

malls

in

the

country. The first flagship Sogo Department Store was opened here as well as

international branded stores, Gucci, Versace, Louis Vuitton, and its latest

flagship store is Zara. The first Debenhams department store was also opened

here.

In

2003,

the

mall

expanded

and

opened

Plaza

Indonesia

Entertainment

Xnter ( EX ).

Entertainment X’nter ( EX )

A

lifestyle

mall

located

in

Plaza

Indonesia

opened

on

February

14

th

, 2004.

Anchored by XXI, Celebrity Fitness, Hard Rock Café and Fashion TV Bar

Grand Indonesia

This mall, opened in 2007, is situated beside

Plaza Indonesia, near Selamat

Datang (welcome) statue. It belongs to PT Djarum, and is set up to become the

Icon of Indonesia retail scene as one of today’s largest upscale shopping mall in

South East Asia. There is also Kempinski Hotel and Residence within. It hosts

Harvey Nichols, Chanel Boutique, Seibu (the Japanese department store), Blitz

Megaplex, and Platinum Fitness First.

Shopping malls in South Jakarta:

Blok M Plaza

|

|

23

The plaza, opened

in 1990,

is

located in Kebayoran Baru. Various snacks and

clothes for daily activities and business attire can be found here.

Cilandak Town Square (Citos)

As the name represents, this mall is located in Cilandak, South Jakarta. Opened

in 2000, CITOS has a number of main tenants, including 21cineplex, Matahari

department store, foodmart and Timezone.

Lifestyle X’nter ( FX )

Located in Sudirman, South Jakarta. It is managed by Plaza Indonesia

Pacific Place

This mall can be considered as one of high end shopping malls, with an

international shopping standard. Opened in November 2007, it is equipped with

Ritz

Carlton

Hotel.

Located

in

Sudirman

Central

Business

District,

the

mall

offers a

lot of

flagship stores such as Bebe, Guess etc. This

high end shopping

mall has five anchor tenants, M Department Store, Kidzania, Kemchicks, Blitz

Megaplex and Best Denki.

Plaza Semanggi

The plaza

is

located

in Semanggi,

with

Balai

Sarbini

function

hall.

There

are

Breadtalk, J.co Donuts & Coffee, Centro Department Store, Starbucks and Planet

Surf in Plaza Semanggi.

Plaza Senayan

One of Jakarta’s premier shopping malls, opened in 1996 is owned by PT

Senayan Trikarya Sempana, the plaza caters two department stores, Metro and

Sogo

department

stores,

and

several boutiques

of

Indonesian

designers

and

international branded stores.

|

|

24

Pondok Indah Mall I & II

This series of malls is one of top shopping malls in Jakarta. PIM I was opened in

the

1980s,

while

PIM

II

was

just

opened

in

2004.

There

are

two

department

stores,

Metro

and

Sogo

department

stores.

PIM

II is completed

with

upscale

designer boutiques. This mall is also popular with expatriates.

Senayan City

This premier mall is located in Senayan and was just opened on June 23®

d

,

2006.

It is anchored by Debenhams department store and Best Denki electronic store. It

also has an apartment tower and a

five-star

hotel operated by Sofitel, a

luxury

hotel

chain.

Senayan

City

represents the

sophisticated

and

modern

Jakarta

lifestyle. It is not designed to be a simple shopping complex, but rather a

manifestation of the city by mixing local and international brands.

Shopping malls in North Jakarta:

Mall Kelapa Gading

It is both a modern shopping mall and an entertainment center. This mall, owned

by PT Summarecon Agung, Tbk., can also be considered as one of

the

largest

shopping mall in Indonesia. It has very complete shop varieties, such as

exclusive

clothing,

teenage shopping area,

wedding shopping

needs,

and

large

varieties of food.

Mall of Indonesia

The mall, built by Agung Sedayu Group, is situated in Kelapa Gading Square

area.

Opened

in

September

2008,

the

mall

is

anchored by

Centro

department

store, Carrefour and Blitz Megaplex. MOI is famous for its small theme park.

Emporium Pluit Mall

|

|

25

This

is a

shopping

center

located

in Pluit. Officially opened

on

January

10

th

,

2009, the mall has two anchor tenants, Carrefour and Sogo. Other tenants include

Gramedia book store, Cinema XXI, Electronic Solution, Zara, Breadtalk, J.Co

Donuts & Coffee, Maystar restaurant and Starbucks.

ITC Cempaka Mas

This trade center has around 6000 kiosks in five floors, is situated nearby

Tanjung

Priok Harbor.

The trade center is

anchored by

Carrefour,

Timezone,

Gramedia and Pizza Hut.

Shopping Mall in East Jakarta :

Tamini Square

Located nearby Taman Mini Indonesia Indah. This shopping mall is anchored by

Carrefour and Ramayana department store

Cibubur Junction

Located

in Cibubur, officially opened on

July 28

th

,

2005. The

mall is anchored

by Matahari department store, Hypermarket and Fitness First.

|

26

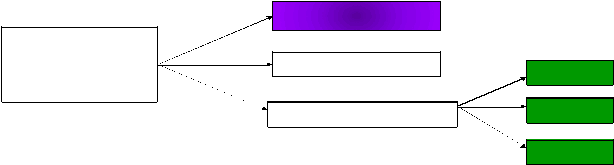

Type of shopping malls in Jakarta :

Trade centers

SHOPPING MALLS

Lifestyle

centers

higher

Regular shopping malls

middle

lower

?

Trade centers are usually

wholesalers’ center

without department store, offer lower

prices goods. ITC Cempaka Mas, ITC Kuningan, ITC Permata Hijau and ITC Kuningan

are trade centers.

?

Lifestyle

centers

in

Jakarta

are

EX

Plaza

Indonesia

and

FX

Sudirman. Those

are

lifestyle malls without department store, they are anchored by Celebrity Fitness and have

cafes and restaurants

?

Regular

shopping malls are common shopping

malls

with department store, can be

found in business districts in Jakarta. Debenhams, Sogo and Seibu are department store

in regular higher level shopping malls. Regular middle level shopping malls are

anchored by Metro Department store.

Cahaya, Yogya, Matahari and Robinson

Department store can be found

in

regular lower class shopping

malls.

Regular

higher

level shopping malls are equipped with food court, restaurants, cafes and theatre. Those

are perfect for social gathering places.

|

|

27

2.2.2 Shopping experience

Shopping experience must be a pleasurable experience and comfort the customers during

their shopping in a certain shopping center. According to (

Ahmed, Gingold,

Dahari.

2005 ), mall management (and mall-based retailers) must now offer something extra to

lure shoppers,

whether

it is a unique experience, entertainment, excitement or a social

gathering place. Although today shopping malls have indirect competitors such as online

shopping, catalogs and home shopping on television that offer practicality, those kinds

of

shopping

could

only compliment

them but

can

never

really

replace

real

“live”

shopping malls.

The spectacular Mall of America contains more than 520 specialty stores, 49 restaurants,

indoor

theme parks, an Underwater World featuring

hundreds of marine

specimens, a

dolphin show and a two-story miniature golf course, all of which can offer an

unforgettable shopping experience which is hard to be copied by any competitor.

In Jakarta, Mall of Indonesia has been designed to attract visitors in the same way as the

Mall of America. It is facilitated with a small theme park and many kinds of fun family

entertainment.

Shopping must be pleasurable or a leisure experience. Today’s customers are more

discerning,

less

loyal

and

more

demanding.

Demand

for

experience

is

viewed

very

highly that malls need to provide more authentic retail brands with clearer relationships

with

the

shoppers.

Berry

et

al.

(1997)

stated that

“fun”

must

become

an

important

consideration to successful retailer value propositions.

|

|

28

Obviously, today’s customers are seeking value, choices and customer experience.

Therefore, current retailers of shopping malls should:

• ©reate a theatrical retailing environment;

• stress fun, excitement and entertainment;

• encourage greater customer participation in the retail service experience (Baron et al.,

2000; Mathwick et al., 2001). To deal with those three things, shopping mall

managers

must pay attention

to

ambient conditions and environmental aspects that

can irritate shoppers.

Ambient conditions which can create the following problems (Lovelock et al, 2005):

• the shopping mall is inadequate of cleanliness

• toilet is neither spacious nor clean;

• inadequate Air Conditioning;

• the music inside the shopping mall is too loud;

• There is bad smell in the shopping mall.

Environmental aspect problems include (Lovelock et al, 2005):

• direction within the shopping mall is inadequate;

• shopping mall does not have good landscape may cause difficulty in finding certain

stores or products;

• inadequate security;

• inadequate escalators and elevators within the shopping mall;

• inadequate parking space;

• Hard to be reached by public transportation.

|

|

29

2.2.3 Behavioral Intentions.

Shopping mall managers must be able to motivate all shoppers’ spending behavior in

order to

grab

more

profits.

This

can be achieved

by

maintaining

loyal

patronage

and

generating positive “Word Of Mouth” (known as the cheapest, fastest and most effective

way to recruit new shoppers).

Soderlund and Ohman (2005) found intentions-as-expectations and intentions-as-wants

are

interrelated

with both customer satisfaction and repatronizing behavior. ( Babin et

al., 1994) cited that individuals generally shop to obtain hedonic and/or utilitarian

values. Utilitarian consumption is when the products are consumed to accomplish a

specific function or a need, whereas hedonic consumption is when the products are

consumed for fun, pleasure and excitement (Rook, 1987 ). Therefore, a shopping mall

would be more profitable and favorable if it could serve and satisfy both types of

shoppers.

When a shopping mall is perceived as exciting, consumers may visit it more frequently

and be less likely to visit other shopping malls (Lumpkin et al., 1986).

2.8 Segmentation Approach

In the past, a research identifying attractiveness factors of shopping malls assumed that

consumers

were homogeneous

in their choice of mall. This assumption contradicts

the

fact

that

consumers

are

different,

and

therefore,

the

market

needs

to

be

segmented

(Suarez et al., 2004). Suarez analyzed different segments of consumers in their shopping

centre

choices.

Boedeker

(1995)

segmented shoppers

into

two

types,

the

“new

type

|

|

30

shoppers” who value both recreational and economic purpose of a shopping mall and the

“traditional shoppers” who got much lower attraction on the recreational aspects.

In the main journal entitled Shopping mall attractiveness: a segmentation approach, (El-

Adly, 2006) segmented shoppers into the following three segments:

•

Relaxed

shoppers,

who

mostly

do

their

shopping

in

the

weekends. This

type

of

segment

mostly concern about comfort,

mall essence and convenience. They prefer

going to shopping malls which provide comfortable seating and rest areas, ample

parking

and safety to enable shoppers to

spend

time

or to

socialize

within

the

shopping malls. In addition, they also concern about store variety, products’ quality,

after sales service, while

they

have

less concern about entertainment, diversity and

luxury of shopping mall. To attract this segment shopping malls should be equipped

with complete supermarkets, good directions inside the mall, shuttle bus service even

good access to reach the mall. However, entertainment, diversity and luxury of

shopping mall are not their priority.

•

Demanding shoppers. Generally, demanding shoppers are a segment of young

people. They have a greater consideration

on entertainment, diversity

and

luxury

rather

than

the

other

two

segments.

They also

have

a

stronger

desire

to

stay

in

shopping malls. Thus, the shopping mall management needs to make this segment

feel

comfortable

to stay

long

in

the

mall,

which

will

automatically

lead

them

to

spend more.

|

|

31

•

Pragmatic

shoppers. This

segment

only concerns

about

the mall

essence

factor. To

them,

products

quality,

appropriateness

of

prices

to

their

income

and

variety

of

stores are very important as they tend to compare prices and quality. Shopping malls

and retailers could offer gift with purchase, quantity discount and gift voucher with a

minimum purchase. To this segment, the entertainment factor is not important when

choosing

a

shopping

mall.

The

existence

of

a

large

food

court, the

presence of a

cinema and

the popularity of

the shopping

mall are

viewed as not

important

from

this segment’s point of view.

|