9

Although

this

thesis

will

only

focus

on

defined

benefit

program, it is important to

distinguish

the

differences

between

the

two

pension

plan

programs.

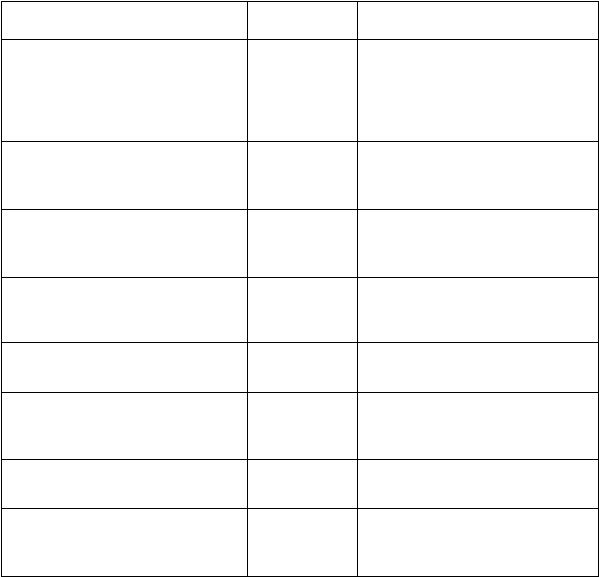

Table

2.1

summarizes

the

main differences between Defined

Benefit Plan and Defined

Contribution Plan to provide a better understanding of Pension Fund.

Define Benefit Plan

Aspect

Define Contribution Plan

Pension benefit is based on the formula

that

has

been

decided

on

the

pension

fund regulation

Pension Benefit

Pension

fund

benefit

depend

on the

amount of

the

accumulated

contribution from

the

result

of

investment until

the

participant stop

working, then

it

will

be

traded

with

insurance company annuity

The value of contribution depends on

the fund adequacy to fulfill the pension

benefit liability based on the actuarial

calculation

Contribution

The value of employer contribution

from the participants contribution has

been set in the Pension Fund

regulation

PSL is recognized and the funding is

entirely the responsibility of the

employer.

Past Service

Liability

(PSL)

No PSL

Investment guidelines placed by plan

sponsor

Investment

Placement

Investment guidelines placed by plan

sponsor and the supervisory body

Plan Sponsor held responsible

Investment

Risk

Participants held responsible (deduct

pension benefit that will be received)

Needed since the beginning and

regularly to calculate the contribution

figure and fund adequacy

Actuarial

calculation

Not needed

Perform by the pension fund

Pension Benefit

Payment

Perform by live insurance company

Continued

Relationship

between

Employer and

retiree

No relationship

Table 2.1 Difference between PPMP and PPIP

Source: Tunggal 1999. p.15-16