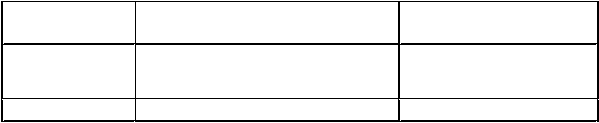

20

dividend yield and stock

return.

Aruoriwo M Independent variable :

In this case, Dividend

payout ratio is the main

determinant

< 2011 > Dividend yield and dividend payout

ratio

in impacting stock return

Table 2.1 Gap from previous studies

Based on the annotation from previous studies that have been done and presented in

table 2.1, there is an inconclusive r esuls of whether dividend policies affect positively,

negatively or even do not affect stock return. Therefore, to fill the gap, the author conduct a

further analysis regarding the relationship between dividend policy and stock return by using

different samples and time period. The study is designed as a study about SRI Kehati listed

companies from 2009 to 2013. The purpose of using the index is to explore the results of the

topic within a different investing environment, i.e.socially responsible investment.

2.3 Conceptual Hypothesis Development

2.3.1 Relations between dividend policies and stock return

Dividend yield is a tool for predicting the value of return in the future.

Dividend payment will change the composition capital in the company, therefore it

leads to the decrease of company’s retained earnings .

The larger amount of dividend distributed to shareholders, it means that

companies have a good performance. As a result, share price will be increase and

there will be an incrase in stock return as well. ( Murhadi, 2008).

There are preceding empirical evidence in different location and period done

by some researchers to scrutinize the relationship between dividend policy and stock