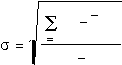

32

n

(kt

k )

t

1

n

1

2.5.4 Risiko Pasar (Market Risk) – Beta

eta

is

sensitivity

of

a

stock's

return

to

the

return

on

the

market

portfolio.

ome

stocks

are

less

affected

than

others

by

market

fluctuations.

efensive stocks

(have

low betass betas

less than 1.0) are

not

very sensitive

to

market

fluctuations. In

contrasts

aggressive

stocks

(have

high

betass

betas

greater

than

1.0) amplify

any

market movements." (Brealey, Myers, Marcus, 2001, p290-291)

eta

is

a

measure

of

the

relationship

between

an

investment's

returns

and

the

market's

returns.

his

is

a

measure of the investment's nondiversifiable

risk."

(Keown, Martin, Petty, Scoot, 2002, p186)